alabama tax lien laws

A lien is a legal claim over an asset held as collateral. Alabama law requires an annual registration tax for utility trailers operated on public highways.

The IRS states a tax lien was placed in 2010 for non-payment of tax penalties for late filing and a mistake by my tax preparer back in 2001.

. It holds a tax lien auction once each year. For example whenever a lender provides funding for the borrower to buy a car house or other significant assets they place a lien on the property so that if the property owner defaults on the loan and doesnt pay the creditor back the financier can sell the property and collect their funds. Once your car loan is repaid the lien holder typically sends a lien release document depending on the state to the state transportation agency so that the title of the car can be updated and transferred to you.

The government issues a tax lien certificate when the lien is placed on the property. The highest bidder receives a tax lien certificate that includes the taxes plus the other fees. I am a disabled Veteran with limited income and the IRS considered the tax as uncollectable at the time.

Please refer to the federal and state contacts included to verify these laws and incentives are still applicable and consult your tax advisor. A federal tax lien is different than a non government lien as private companies are the lien holders on assets or property which establishes that the government has a monetary interest in a person. A lien serves to guarantee an underlying obligation such.

A lien is a legal right granted by the owner of property by a law or otherwise acquired by a creditor. Depending on the state the lien holder will file the lien with your states transportation agency or department of motor vehicles. Visit My Alabama Taxes for filing Individual Income Tax returns including free filing of federal returns visit the Alabama Individual Income Tax Electronic.

The buyer pays the tax all accrued interest an advertising fee a certificate fee an auction fee and any premium amount the buyer bids. Colorado is a tax lien sale state. The fee is 12 for personal trailers and 15 for commercial trailers as of 2010.

Standard RA9 Search logic mandated by the UCC Statute and locates exact matches excluding noise words and abbreviations as provided below. Tax Lien Sales. This information provides an overview of laws and incentives and should not be your only source of information for making decisions about vehicle purchases taxes or other binding agreements.

This tax lien is typically applied by the IRS in order to obtain payment for the back taxes or they can come after financial and property assets. However as of July 1 2009 utility trailers pulled behind automobiles are exempt from title laws. This document includes details of the property the amount owed and any additional charges such as interest.

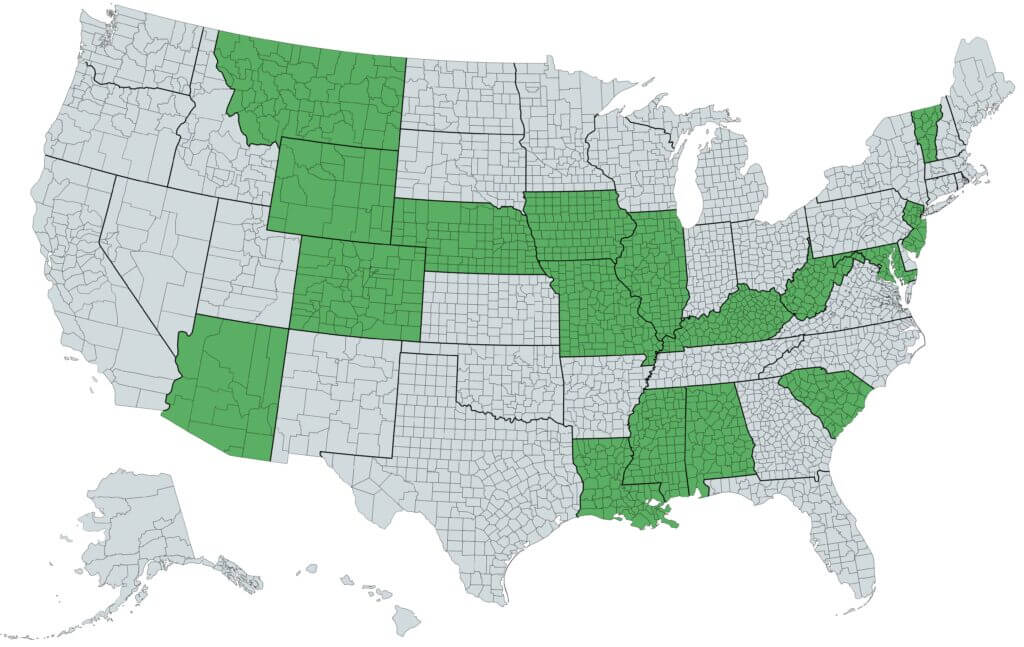

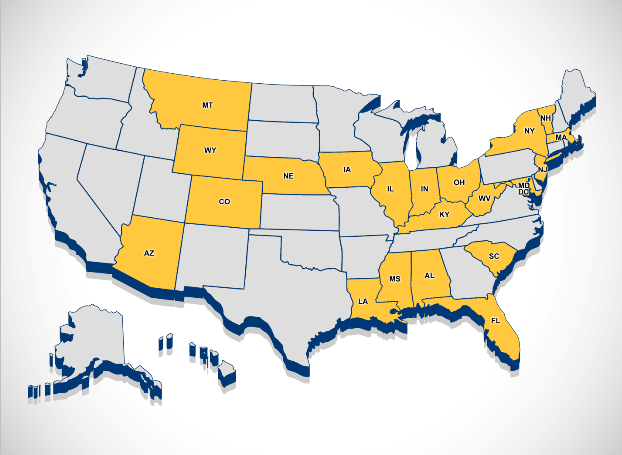

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Alabama Tax Sales 12th Edition 2018 Denise Evans 9781732862401 Amazon Com Books

Free Arkansas Bill Of Sale Form Pdf Template Legaltemplates With Regard To Car Bill Of Sale Word Template Cumed Org Arkansas Rv

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

How To Stop Child Support From Taking A Tax Refund Prevent Tax Refund Interception

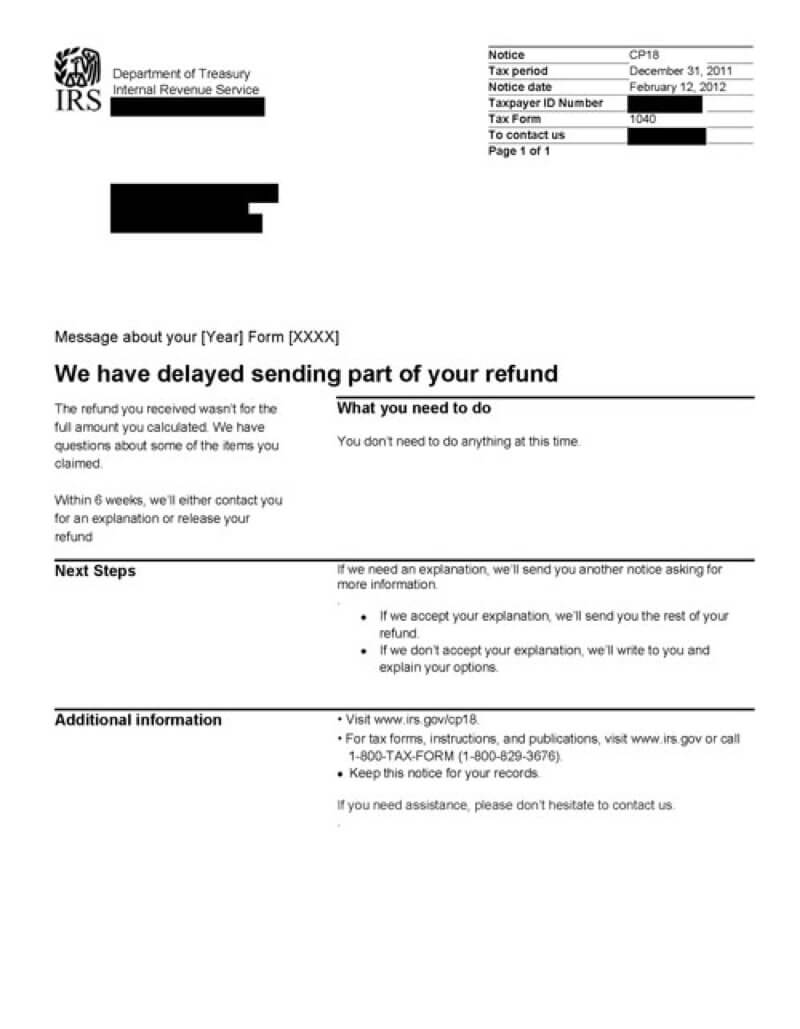

What Is A Cp18 Irs Notice Jackson Hewitt

The Essential List Of Tax Lien Certificate States

Quiet Title Program Birmingham Land Bank Authority

Sales And Use Alabama Department Of Revenue

:max_bytes(150000):strip_icc()/edit_BAG5628-d1d046715e1748c88a36ccd84731b1df.jpg)